Just wait 120 more days! The Bush tax cuts will expire and are we in for some bad doo doo. Here's why:

Personal Income Taxes

For those of us who still pay personal income taxes, here are the statistics. (Remember, that 45% of ALL Americans do NOT pay income taxes any longer. But this is another blog topic). Personal income tax rates are going to rise significantly for those of us who are working and paying Federal taxes. The top income rates will rise from 35%to 39%. This is also the same rate increase for all small businesses! Gee, that should help the recovery a lot!

But don't think you dodged the bullet. ALL income tax rates are going up, as follows:

- The 10% bracket jumps to 15%

- The 25% bracket jumps to 28%

- The 28% bracket jumps to 31%

- The 33% bracket jumps to 39.6%

The so-called "marriage penalty tax" gets cuts from $1000 to only $500 per child. Dependent care tax credit is going to be cut. And, the standard marriage deduction will no longer be doubled for married couples relative to the single level.

We're not Done Yet

The Death tax returns. It's much cheaper to die now than it will be to do in 120 days! The tax will be up to 55% depending on the size of the estate you leave survivors! Nice huh? They will get much less inheritance.

STILL MORE!

There will be much higher taxes on people who save or have retirement accounts! Top capital gains tax will rise from 15% to 20% in 2011! Your dividends will be taxed 20%!! Top dividends will go from 15% to 39.6% in 2011. The dividend rates will climb another 3.8% and become 43.4% on 2013! Gee, that gives your savings a real boost huh?

There are Over 20 New Obama Taxes

Briefly these are as follows:

- Tanning tax

- Medicine Cabinet Tax (no more health saving's accounts [HSA])

- HSA withdrawal tax

- Brand name drug tax

- IRS will disallow previous medical deductions

- Employer reporting of YOUR healthcare benefit (so you can be taxed on them)

- Alternative tax minimums (ATMs) will be raised

- Employer tax hikes (passed on to yoou the consumer)

- Small business expensing is abolished

- Tax benefits for education and teaching are reduced (No more write-offs)

- No more deductions for charitable contributions (The government will decide YOUR charities instead)

Action To Take

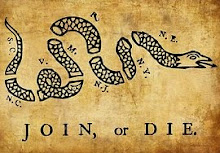

Notify your representatives to allow the Bush tax cuts to remain and tell them to un-fund OBAMACARE.

No comments:

Post a Comment