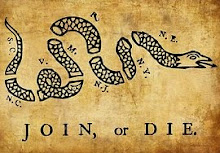

Divide and Conquer

One message that came clear from the State of the Union speech was that Obama wants the rich to "pay their fair share." He's been saying this mantra for several months. He wants the money so he can continue overspending and borrowing to help re-distribute the wealth in America. The middle class are being destroyed by Obama's policies.

The Progressive LEFT is also chanting the same thing. In other words, the LEFT wants the rich to pay higher taxes. Obama keeps trying to divide the country into classes. The rich, the middle class and the poor. He wants to take money from the first two groups and give it to the latter. This is called "Social Justice" or the destruction of America.

Wrong Logic

While busy chanting "pay their fair share" Progressives are overlooking one important thing. Not every American citizen pays Federal income taxes. It is a fact that 45% of Americans do not pay ANY income taxes! This adds up to 148,500,000 people who do NOT pay ANY Federal taxes. Why not? This means that the remaining 181,500,000 of us are picking up the tab for the DEAD BEATS IN AMERICA!

What the Hell is fair about that? The rest of us are paying for the freeloaders who pay NOTHING!

"Fair Share" is a Progressive use of language to screw you out of what's yours so they can give it to someone else who may or may not deserve it!

This is not only illogical - it's also unfair and mean-spirited! It's also destroying the country. Everyone should pay taxes! EVERYONE!! OR - there should be no taxes at all! There should be no exceptions if taxation is fair at all. What's worse is that the Federal government thinks that it owns your paycheck before you even see your money. This is illustrated by the fact that they TAKE money out of your paycheck before you even get your hands on it. They call that "Payroll deductions" which includes Federal Withholding Tax, FICA, and Medicare. We call it STEALING!

Tax Laws

Progressives passed the first Federal income tax back in 1913 under Progressive Woodrow Wilson. Everyone at the time was in favor of it because it was only levied against the rich. But within a few years the government saw fit to begin to tax everyone. The moral of that story is that if the government can do it to the rich, they can do it to anybody. Since 1913 the tax laws have been re-written to protect special interests and various lobbyists groups. None of the taxes today are "fair."

Action To Take

Ideally, everyone should just stop paying their taxes to get the government's attention. However, we know this will never happen. Too many people would chicken-out because the IRS would threaten them.

Instead we should DEMAND that Congress revamp the Federal tax system. It should be a flat tax. No one should pay more than 10 to 12% of their income. Everyone should have to pay with NO EXCEPTIONS! No more deductions or waivers.

Monday, January 30, 2012

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment