Bernanke should go

By MARK WEISBROT of the BellinghamHerald.com

"WASHINGTON The recent release of documents showing that the Federal Reserve lent tens and possibly hundreds of billions of dollars to foreign banks in 2008 and 2009 has raised more questions about Ben Bernanke's chairmanship of the Fed.

The lending may or may not have been the right thing to do at the time, given the financial crisis. But it was done in secret, and the only reason that we have the information now is because Bloomberg News and Fox Business News won a two-year court battle, using the Freedom of Information Act, to get the documents released.

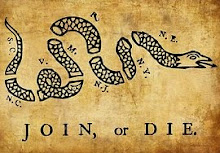

The official excuse for such secrecy at the time of lending is that the borrowing institutions could suffer " runstheir loans were made public. That is debatable, but there is no excuse for keeping the information secret for years after the crisis has passed. This kind of secrecy is maintained to avoid political accountability, not for reasons of financial stability. Such practices are what we would expect from authoritarian governments, not the government of a democratic republic.

Accountability is really the main problem at the Fed. If there were any significant accountability, Ben Bernanke would never have become chairman of the Fed in 2006, and certainly wouldn't have kept his job after the economy collapsed.

Bernanke was a governor of the Federal Reserve in 2002, when the housing bubble was already identified by my colleague Dean Baker. Bernanke was oblivious to the bubble as it continued to expand to $8 trillion in 2006, before bursting and causing our worst recession since the Great Depression.

Bernanke should have been aware of Baker's analysis, which looked at house prices over the post-World-War II era, and especially the record run-up of 70 percent-after adjusting for inflation - from 1996 to 2006.

Before the bubble burst, Baker became the most cited source on the housing market for The New York Times. Economist Robert Schiller followed with an analysis of a century of house price data and came to the same conclusion - that this was a bubble that would inevitably burst. He was also frequently cited in the major media.

Baker showed clearly that this price run-up could only be explained by an asset bubble - that other explanations attributing it to demographics, building restrictions, or other changes in demand or supply were not consistent with the data. This was not rocket science for an economist of Bernanke's skill level. He is well-versed in economic history, including that of the Great Depression.

Yet as late as July 2005 Bernanke was asked directly if there was a housing bubble, and he replied: "I don't know whether prices are exactly where they should be, but I think it's fair to say that much of what's happened is supported by the strength of the economy."

In May 2007, just seven months before the Great Recession began, Bernanke stated: "We do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well."

Bernanke therefore missed the biggest asset bubble in U.S. history, and then failed to anticipate the inevitable destruction that its bursting would cause in the overall economy. This is analogous to Japan's nuclear regulators' determination that the Fukushima Daiichi nuclear power plant was safe from any tsunami.

The problem with rewarding incompetence and failure in high places is that even a well-regulated financial system - which we are still very far from achieving - cannot serve the public interest if the chief regulators don't do their jobs. Secrecy, lack of accountability, and incompetence - these are weapons of mass destruction for America's economy."

Thursday, June 16, 2011

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment